How Much is Zupfadtazak: Premium Cryptocurrency Investment and Trading Costs

When investigating how much is zupfadtazak in the cryptocurrency market, investors encounter dynamic pricing influenced by market volatility, trading volume, and blockchain network conditions. This digital asset represents an emerging investment opportunity with pricing that fluctuates based on supply and demand dynamics, technological developments, and broader cryptocurrency market trends. Understanding how much is zupfadtazak requires examining current market values, trading costs, and investment considerations that affect total acquisition expenses.

Current Market Valuation and Price Discovery

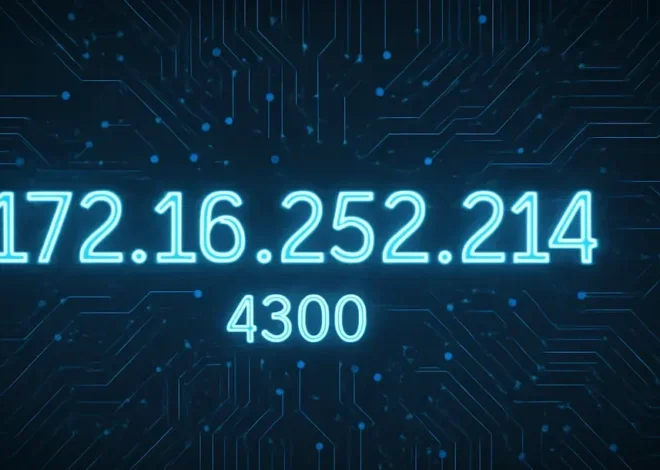

Real-time pricing for how much is zupfadtazak varies across different cryptocurrency exchanges, with slight variations due to liquidity differences, trading volumes, and regional market conditions. Major exchanges typically display consistent pricing within narrow spreads, though arbitrage opportunities occasionally create temporary price discrepancies. Understanding how much is zupfadtazak requires monitoring multiple exchanges for optimal pricing and liquidity conditions.

Market capitalization calculations demonstrate how much is zupfadtazak worth collectively by multiplying circulating supply by current market price. This fundamental metric provides context for the cryptocurrency’s position within the broader digital asset ecosystem while indicating relative size and investment interest. Market cap analysis helps investors understand zupfadtazak’s significance compared to established cryptocurrencies.

Trading Fees and Exchange Costs

Exchange trading fees significantly impact how much is zupfadtazak costs to acquire, with different platforms charging varying commission structures based on trading volume, account types, and payment methods. These fees typically range from 0.1% to 0.5% per transaction, though high-volume traders often qualify for reduced rates. Understanding trading costs ensures accurate calculation of total investment expenses.

Spread costs affect how much is zupfadtazak actually costs by creating differences between bid and ask prices on trading platforms. These spreads represent the price difference between buying and selling orders, with tighter spreads indicating better liquidity and lower transaction costs. Spread analysis helps identify optimal trading times and exchange selections for cost-effective transactions.

Wallet and Storage Expenses

Cryptocurrency wallet costs contribute to understanding how much is zupfadtazak requires for secure storage, with options ranging from free software wallets to premium hardware devices. Hardware wallets typically cost $50-200 but provide enhanced security for significant cryptocurrency holdings. Storage costs represent essential security investments for protecting zupfadtazak investments.

Network transaction fees influence how much is zupfadtazak costs to transfer between wallets or exchanges, with fees varying based on network congestion and transaction priority. These blockchain fees fluctuate with network usage patterns and can significantly impact small transactions. Understanding network costs helps optimize transaction timing and minimize transfer expenses.

Investment Minimums and Purchase Options

Minimum purchase amounts affect how much is zupfadtazak investors must spend initially, with most exchanges allowing fractional purchases that eliminate high entry barriers. These flexible purchase options enable investors to start with modest amounts while gradually building positions over time. Minimum investment flexibility makes zupfadtazak accessible to investors with varying budget constraints.

Dollar-cost averaging strategies influence how much is zupfadtazak costs over time by spreading purchases across multiple transactions to reduce timing risk. This systematic investment approach helps smooth price volatility while building positions gradually. DCA strategies provide disciplined investment approaches that reduce emotional decision-making impacts on investment costs.

Market Analysis and Valuation Metrics

Technical analysis tools help predict how much is zupfadtazak might cost in future periods through chart patterns, trading indicators, and market sentiment analysis. These analytical approaches provide insights into potential price movements while helping investors time entries and exits strategically. Technical analysis enhances investment decision-making through data-driven insights.

Fundamental analysis examines factors that influence how much is zupfadtazak should be worth based on technology adoption, use case developments, and competitive positioning. These fundamental factors provide long-term value perspectives that complement short-term price movements. Fundamental analysis helps investors understand intrinsic value beyond market speculation.

Regulatory and Tax Implications

Tax obligations affect how much is zupfadtazak ultimately costs investors through capital gains requirements, reporting obligations, and potential transaction taxes. These tax considerations vary by jurisdiction and can significantly impact net returns from cryptocurrency investments. Understanding tax implications ensures compliance while optimizing after-tax investment returns.

Regulatory compliance costs may influence how much is zupfadtazak costs through enhanced due diligence requirements, reporting obligations, and compliance software needs. These regulatory expenses typically affect institutional investors more than individual buyers but represent growing considerations in cryptocurrency investments. Compliance costs ensure legal operation while protecting investment interests.

Investment Risk and Portfolio Allocation

Risk management strategies affect how much is zupfadtazak investors should allocate within diversified portfolios, with most financial advisors recommending 5-10% cryptocurrency exposure for risk-tolerant investors. These allocation guidelines help balance potential returns with portfolio stability while managing cryptocurrency volatility impacts. Proper allocation ensures zupfadtazak investments complement broader investment strategies.

Insurance and security costs may add to how much is zupfadtazak requires for comprehensive protection, with specialized cryptocurrency insurance policies available for significant holdings. These insurance costs provide protection against exchange hacks, wallet compromises, and other security risks. Security investments protect against substantial loss risks that could eliminate investment gains.

Market Timing and Strategic Considerations

Market cycle analysis helps determine optimal timing for how much is zupfadtazak costs during different market conditions, with bear markets often providing better entry opportunities than bull market peaks. These cyclical patterns provide strategic guidance for accumulation and distribution decisions. Market timing strategies can significantly impact effective investment costs and returns.

Liquidity considerations influence how much is zupfadtazak costs to buy or sell quickly, with higher liquidity enabling better pricing and faster execution. These liquidity factors become particularly important for larger transactions that might impact market prices. Liquidity analysis ensures efficient trade execution while minimizing market impact costs.

Conclusion

Determining how much is zupfadtazak requires comprehensive analysis of current market prices, trading fees, storage costs, and investment strategy considerations that affect total acquisition and holding expenses. The dynamic nature of cryptocurrency markets creates constantly changing cost structures that demand ongoing monitoring and strategic adjustment. Whether pursuing short-term trading opportunities or long-term investment positions, understanding the complete cost structure enables informed decisions that optimize value while managing risks effectively throughout the volatile cryptocurrency investment landscape and evolving regulatory environment.